179 Deduction 2025 - Irs Section 179 Bonus Depreciation 2025 Jacob Wilson, The section 179 deduction is a tax code that allows businesses to deduct the full purchase price of qualifying equipment and/or software from their gross income. Irs Section 179 Bonus Depreciation 2025 Jacob Wilson, How does section 179 work?

Irs Section 179 Bonus Depreciation 2025 Jacob Wilson, The section 179 deduction is a tax code that allows businesses to deduct the full purchase price of qualifying equipment and/or software from their gross income.

Section 179 Deduction 2025 2025, The section 179 deduction and bonus depreciation provide additional deductions to income in year a vehicle is placed in service thereby reducing a company's tax liability.

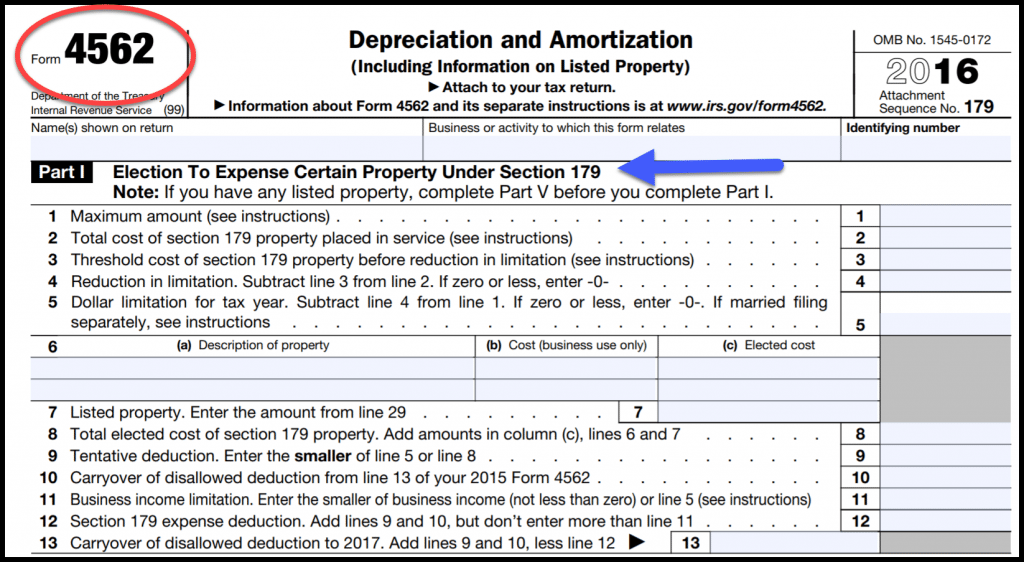

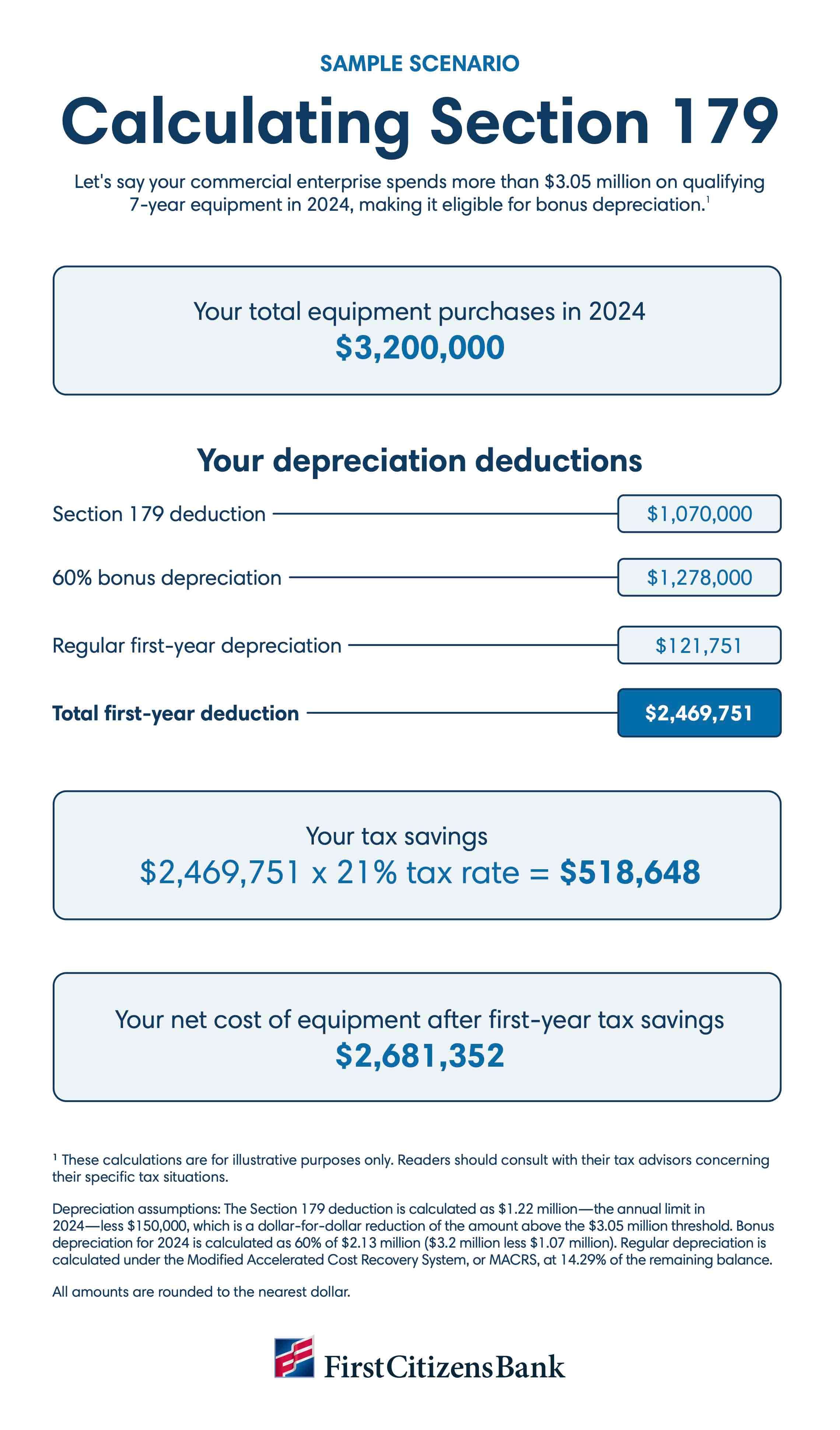

179 Deduction 2025. The deductions decrease the depreciable basis of the vehicle for. In 2023, the maximum section 179 deduction was $1,160,000.

Depreciation 101 Is the Section 179 Deduction Right for your Business, For tax years beginning in 2025, the same deduction will max out at $1.25 million and begin to phase out when 2025 qualified asset additions exceed $3.13 million.

Section 179 Deduction 2025 Vehicle List Lesly, Two federal tax breaks can be a big help in achieving this goal:

Wsf Grand Nationals 2025. Teams must win a bid at a cheerleading worlds bid. Stream or cast from your desktop,...

Section 179 Deduction 2025 Vehicles Ryan Davies, Two federal tax breaks can be a big help in achieving this goal:

Oregon Archery Elk Season 2025. It targets information for big game hunters, such as deer, elk, and bighorn sheep. Archery...

Eligible vehicles include heavy suvs, work vehicles,. Section 179 expense allows the taxpayer (except trusts and estates) an immediate deduction on certain types of depreciable property.

Phil Groundhog 2025. Punxsutawney phil is a superstar prognosticating groundhog from punxsutawney, pennsylvania. What you need to know as punxsutawney...

Section 179 Deduction for Business Equipment How it Works, Irs (internal revenue section) section 179 deduction allows business owners to deduct the full purchase price of certain equipment for the year it was placed in service.